Question 1:

The following transactions entered into by XYZ Ltd for the year ended 31 December 2017:

- R18 000 was paid for rent expense for the period of 1 March 2017 to 28 February The monthly payments were constant throughout this period.

- Wages and salaries for 2 months are outstanding, R2 000 is paid monthly for wages and

- XYZ LTD received a 6-month cleaning service fee of R600 up-front (for 1 January 2018 till 30 June 2018) from Ceasers

- Interest received from BBC Bank for the year amounted to R8 000. The fixed deposit for XYZ LTD at BBC Bank at the beginning of the year was R100 000 and remained unchanged throughout the year. Its maturity date is 31 December 2025. The interest rate is 10% per

- Skywalk Distributors bought vehicle to the value of R100 000 on 31 March An amount of R8000 for the current financial year has to be written off as depreciation on vehicle.

Additional information

The financial year end for XYZ Ltd is 31 December.

REQUIRED:

Identify and explain the type of adjustment raised in each transaction entered into by XYZ Ltd. Show how each adjustment will be reflected in the general journal for XYZ Ltd for the year ended 31 December 2017.

Question 2:

The following transactions during January 2017 relate to F Freddy, an attorney. Date Transactions Amount

2017 R

Jan 3 F Freddy deposited as opening capital 20 000

Paid rent for January 2017 2 300

- Bought law library on credit from Book Limited 24 000

- Bought a typewriter for cash from Leo Limited 1 700

- Provided services for cash 7 200

- Debited D Dunn with fees for services rendered 8 318

- Leo Limited repaired equipment on credit 100

13 F Freddy drew a cheque for private use 1 234

18 F Freddy received commission on a property transaction 1 350

- Paid the following by cheque

- Salaries 8 350

- Leo Limited (on account) 100

- Received payment from D Dunn on his account 1 500

REQUIRED:

Record the transactions for F Freddy in the Accounting Equation. Structure your answer as the table provided below (indicate the decrease by minus sign (–) and the increase by plus sign (+)):

ASSETS = EQUITY + LIABILITIES

| Date | Library and Equipment | Debtors | Bank |

= |

Capital | Income/ Expenditure |

+ |

Creditors |

| Total |

Question 3:

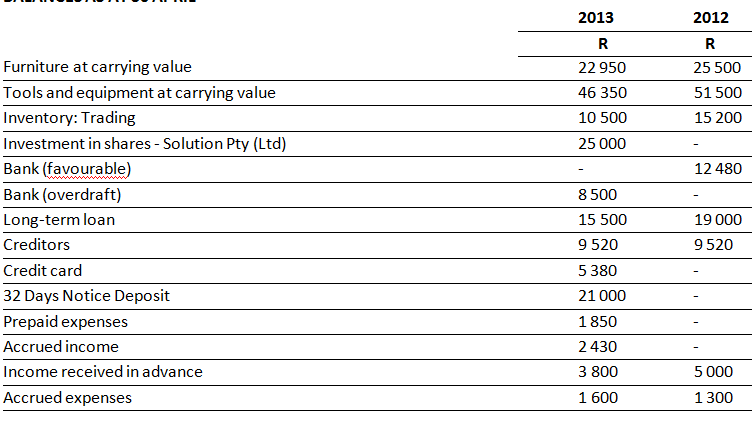

S Man runs a small business, MANDLAS from home. S Man does not keep proper accounting records. He needs to calculate the entity’s profit/loss and requests your assistance. You established the following:

+

Additional information

- S Man withdrew R20 000 during the 2013 year for own

- During the 2013 financial year S Man deposited R30 000 from his personal bank account into the business bank

- The interest on the long-term loan for the 2013 financial year must still be provided for. Interest is charged at 11% per annum on the outstanding balance on 30 April.

REQUIRED:

- Prepare the statement of financial position of MANDLAS as at 30 April (16) All the necessary calculations must be shown.

- Prepare the statement of assets and liabilities as at 30 April 2012 and calculate the equity balance as at 30 April (6)

Calculate the estimated profit or loss for the year ended 30 April 2013.

Answers to Above Questions on Accounting

Answer 1: The type of adjustment raised in each transaction entered into by XYZ Ltd is explained as follows:

Get completed assignment answers on above accounting assignment from the accounting assignment help in South Africa experts available with Student Life Saviour.

Content Removal Request

If you believe that the content above belongs to you, and you don’t want it to be published anymore, then request for its removal by filling the details below. It will only be removed if you can provide sufficient evidence of its ownership.